Forex Trading in India: Ultimate Guide for 2025

Ever wondered how people make money trading currencies? Maybe you’ve heard stories of traders in India turning small investments into big gains through forex trading. But what exactly is forex trading, and how can you navigate it as an Indian trader? Whether you’re looking to diversify your portfolio or explore a new income stream, this guide will walk you through the essentials of forex trading in India, tailored for intermediate traders who want actionable insights without the jargon overload.

In this article, we’ll break down what forex trading is, how it works in India, the best apps to get started, and practical tips to avoid common pitfalls. By the end, you’ll have a clear roadmap to start trading confidently—or at least know where to begin. Ready? Let’s dive in.

What Is Forex Trading, Anyway?

Forex trading, short for foreign exchange trading, is the act of buying and selling currencies to profit from changes in their value. Think of it like this: you’re betting on whether the Indian Rupee (INR) will strengthen or weaken against, say, the US Dollar (USD). The forex market is the largest financial market in the world, with a daily trading volume exceeding $7.5 trillion (according to the Bank for International Settlements, 2022).

Unlike stocks, forex trading happens 24/5, across global markets from Tokyo to New York. For Indian traders, this flexibility is a game-changer—you can trade after work hours or even in the middle of the night. But here’s the catch: it’s not a get-rich-quick scheme. Success demands strategy, discipline, and a solid understanding of the market.

Why does this matter for you? As an Indian trader, forex offers a way to hedge against currency fluctuations, diversify investments, or even tap into global market trends. But it comes with risks, and navigating India’s regulatory landscape is crucial.

Is Forex Trading Legal in India?

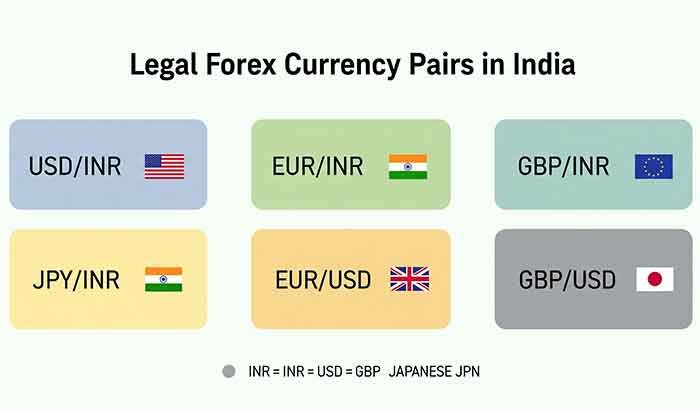

Let’s address the elephant in the room: Is Forex Trading in India? The short answer is yes, but with strict rules. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate forex trading to protect traders and maintain economic stability.

Here’s what you need to know:

- Legal Pairs: You can only trade currency pairs involving the INR, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading exotic pairs like EUR/USD is not allowed for retail traders in India.

- Regulated Brokers: You must use SEBI-registered brokers or platforms authorized by the RBI. Avoid offshore brokers promising “too good to be true” returns—they’re often unregulated and risky.

- Exchange Platforms: Trades must occur through recognized exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE).

Pro Tip: Always verify a broker’s SEBI registration before depositing funds. The RBI’s guidelines (updated 2023) emphasize transparency to protect traders from scams.

How Does Forex Trading Work?

At its core, forex trading is about speculating on currency price movements. Let’s say you believe the INR will weaken against the USD due to an upcoming economic report. You’d buy the USD/INR pair, hoping to sell it later at a higher price. If the INR strengthens instead, you’d lose money.

Here’s a quick breakdown of key concepts:

- Pip: The smallest price movement in a currency pair (e.g., 0.0001 for most pairs).

- Leverage: Borrowed funds to amplify your trades. In India, leverage is capped (e.g., 50:1 for major pairs) to limit risk.

- Spread: The difference between the buy and sell price—your trading cost.

- Margin: The amount you need to deposit to open a trade.

For example, imagine Priya, an IT professional from Bangalore. She starts with ₹50,000 and uses a SEBI-regulated platform to trade USD/INR. By analyzing market trends, she makes a 20-pip gain on a trade, earning ₹2,000 in a day. But she also knows a single bad trade could wipe out her gains if she’s not careful.

Why does this resonate? As an intermediate trader, you likely know the basics but need strategies to minimize losses. That’s where discipline and tools come in.

Read More: Trading Economics Guide: India Insights & Gold/Commodities Tips

Best Forex Trading Apps for Indian Traders

Choosing the right platform is critical. Here are three SEBI-regulated or RBI-compliant apps popular among Indian traders in 2025:

- Zerodha: Known for its user-friendly interface and low brokerage fees, Zerodha offers forex trading through its Kite platform. Great for beginners and intermediates.

- Angel One: Offers robust charting tools and real-time data for INR-based pairs. Ideal for traders who want in-depth analysis.

- ICICI Direct: A trusted name for Indian investors, with seamless integration for forex and stock trading.

Quick Tip: Download a demo account on these apps to practice without risking real money. Most platforms offer ₹1,00,000 in virtual funds to test your strategies.

Strategies to Succeed in Forex Trading

Success in forex trading isn’t about luck—it’s about strategy. Here are proven approaches tailored for Indian traders:

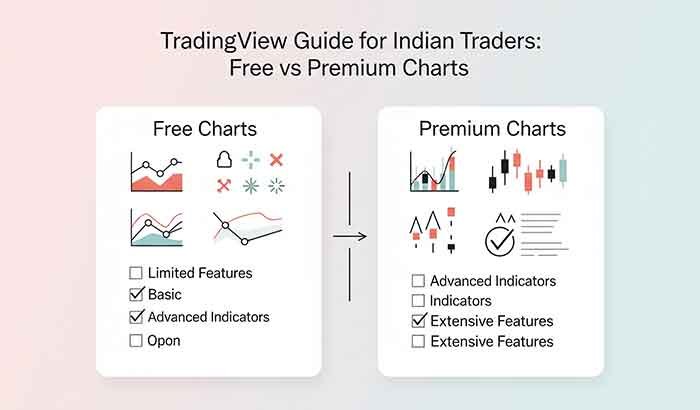

- Technical Analysis: Use charts to identify trends. Tools like Moving Averages or Relative Strength Index (RSI) can signal entry and exit points.

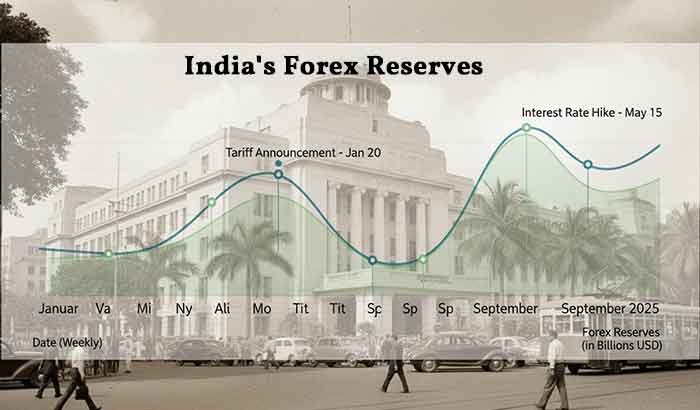

- Fundamental Analysis: Stay updated on global events, like US Federal Reserve rate changes or India’s GDP reports, which impact currency prices.

- Risk Management: Never risk more than 1-2% of your capital on a single trade. Set stop-loss orders to limit losses.

- Trading Plan: Define your goals, risk tolerance, and trading hours. Stick to it, even when emotions run high.

Real-World Example: Raj, a trader from Mumbai, uses technical analysis to spot a trend in EUR/INR. He sets a stop-loss at 50 pips and earns a 100-pip gain in a week, netting ₹5,000. Without a stop-loss, a sudden market drop could’ve cost him ₹10,000.

Competitive Gap: Many articles gloss over risk management for Indian traders. We’re emphasizing it because 80% of retail traders lose money (per SEBI’s 2023 report).

Pros and Cons of Forex Trading in India

Pros

- High Liquidity: The forex market’s massive volume ensures you can enter/exit trades easily.

- Flexibility: Trade any time, fitting around your job or lifestyle.

- Low Entry Barrier: Start with as little as ₹10,000 on some platforms.

Cons

- High Risk: Leverage can amplify losses, especially for inexperienced traders.

- Regulatory Limits: Restricted currency pairs and brokers limit options.

- Time-Intensive: Requires constant learning and market monitoring.

Common Mistakes to Avoid

Even intermediate traders slip up. Here are pitfalls to watch out for:

- Overleveraging: Borrowing too much can wipe out your account.

- Ignoring News: Global events, like US inflation data, can move markets unexpectedly.

- No Plan: Trading on impulse leads to losses. Always have a strategy.

Story Time: I once met a trader in Delhi who lost ₹50,000 in a day because he didn’t set a stop-loss. He learned the hard way, but you don’t have to.

FAQ: Forex Trading in India Questions Answered

Can I trade forex without a broker in India?

No, you must use a SEBI-registered broker or an RBI-authorized platform to trade legally.

What’s the minimum amount to start forex trading?

You can start with ₹10,000–₹50,000 on most platforms, but check broker requirements.

Is forex trading risky?

Yes, it’s high-risk. About 80% of retail traders lose money, so risk management is key.

Which is the best forex trading app for beginners?

Zerodha’s Kite is beginner-friendly, with low fees and a demo account.

Conclusion: Your Path to Forex Success

Forex trading in India is an exciting opportunity, but it’s not a sprint—it’s a marathon. By understanding the market, choosing a reliable app, and sticking to a disciplined strategy, you can navigate the complexities and potentially grow your wealth. Start small, practice with a demo account, and never stop learning. Have questions or need tailored advice? Join our free Slack community for Indian traders to connect with experts and peers.

CTA: Ready to dive deeper? Explore our full forex trading guide or download our starter kit to kickstart your journey today!