India Forex Reserves: A Robust Shield for the Rupee in 2025 and Beyond

It’s the height of a global market frenzy—think oil prices spiking, tariffs flying from the US, and whispers of a trade war echoing across boardrooms. Your portfolio’s taking a hit, the rupee’s wobbling, and you’re glued to your trading app, wondering if India’s got the firepower to steady the ship. As someone who’s spent years dissecting these swings—first as a currency trader in Mumbai’s buzzing forex pits, then advising funds on emerging market bets—I get that knot in your stomach. But here’s the good news: India Forex Reserves are flexing harder than ever in 2025, crossing the magical $700 billion mark and acting like a trillion-dollar dream just within reach. These aren’t just numbers on a screen; they’re your buffer against chaos, keeping the INR from freefalling and opening doors for savvy trades.

In this deep dive, we’ll unpack everything from the latest figures to the wild ride of historical trends, and even eye that $1 trillion horizon everyone’s buzzing about. Whether you’re eyeing carry trades or just want to sleep better knowing the RBI’s got your back, stick around. Let’s break it down like we’re chatting over chai—straight talk, no fluff.

Table of Contents

What Exactly Are Forex Reserves, and Why Should Traders Care?

At its core, India Forex Reserves are the war chest of foreign currencies, gold, and other assets stashed away by the Reserve Bank of India (RBI). Think of it as the country’s emergency fund for international dealings—paying for imports, settling debts, or stepping in when the rupee gets jittery. For intermediate traders like you, this matters big time: Strong reserves mean less volatility in USD/INR pairs, smoother remittance flows for your NRI clients, and a greener light for risk-on bets in Indian equities.

Break it down simply:

- Foreign Currency Assets (FCA): The lion’s share—mostly US dollars in Treasury bonds, euros, and yen. These are your liquid warriors, ready to defend the rupee.

- Gold Reserves: A shiny hedge against inflation; India’s been stacking more of these lately, up to around 880 tonnes valued at $92 billion.

- Special Drawing Rights (SDRs): IMF-issued credits, like global IOUs worth about $19 billion.

- Reserve Position in IMF: A small but steady $4.7 billion slice.

Why the obsession? In a world where geopolitics can tank currencies overnight, these reserves cover over 11 months of imports—a comfort zone that screams stability. For traders, it’s a signal: Lower intervention risk means you can focus on alpha from fundamentals, not firefighting currency crashes.

Read More: Trading Economics Guide: India Insights & Gold/Commodities Tips

The 2025 Snapshot: Reserves Hit $700 Billion—But What’s Driving the Surge?

Fast-forward to September 2025: India Forex Reserves clocked in at $702.97 billion for the week ending September 12, up $4.7 billion in a single week. That’s the third straight weekly gain, pushing us past the $700 billion milestone for the first time since late 2024’s peak of $704.89 billion. FCA jumped to $587 billion (up $2.5 billion), gold to $92.4 billion (a $2.1 billion boost), and SDRs ticked up too.

But hold on—is this sustainable? Year-to-date 2025, we’ve added about $60 billion, reversing a dip earlier in the year when tariffs hammered the rupee to 88.12 per dollar. RBI Governor Sanjay Malhotra nailed it post-policy review: These holdings shield us from shocks, covering 96% of external debt.

For you as an Indian trading enthusiast, this means opportunity. Higher reserves often correlate with INR appreciation—spot USD/INR dipping below 83 could spark a rally in export-heavy stocks like IT and pharma. Just remember, it’s not all roses; a stronger rupee might pinch exporters’ margins.

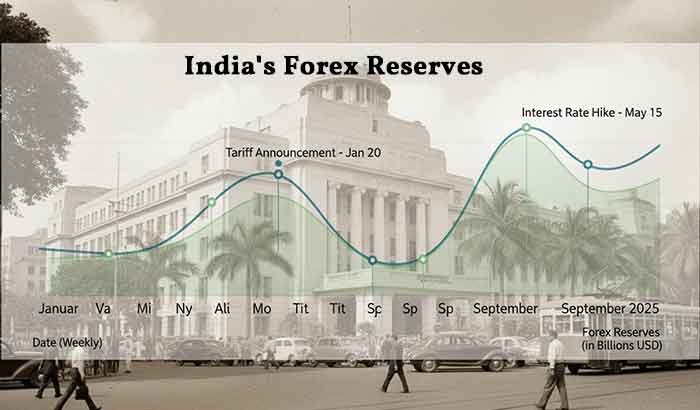

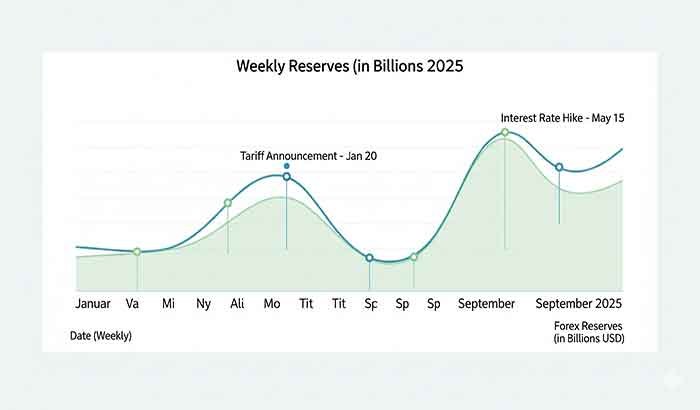

Tracking the Journey: A Visual History of India Forex Reserves

Nothing tells a story like numbers over time, right? India’s reserves have ballooned from a precarious $5.8 billion in 1991 (barely two weeks of imports during the crisis) to today’s powerhouse status. By 2004, we hit $100 billion; 2015 saw $350 billion; and the pandemic-fueled surge took us to $600 billion in 2021.

To make it trader-friendly, here’s a snapshot of yearly closes (in USD billion, end-of-year):

| Year | Total Reserves | Key Event/Change |

|---|---|---|

| 2015 | 353 | Oil price crash boosts inflows |

| 2020 | 537 | Crossed $500B amid COVID stimulus |

| 2021 | 642 | All-time high; service exports boom |

| 2022 | 571 | Dip from rate hikes; $71B outflow |

| 2023 | 629 | Rebound with $58B addition |

| 2024 | 704 | Peak at $704.89B in Sep |

| 2025 (Sep) | 703 | $60B YTD gain; gold diversification |

Sources: RBI data via Trading Economics and Wikipedia.

And for that visual punch? Check this line chart plotting the climb—it’s like watching a bull market in slow motion.

See that steady uptrend post-2020? It’s fueled by remittances ($100B+ annually), IT exports, and FDI inflows—gold for traders spotting patterns in EM currencies.

The $1 Trillion Dream: Realistic by 2029, or Just Hype?

Ah, the big one—India Forex Reserves $1 Trillion. It’s not sci-fi; analysts at JM Financial and Kotak peg it for FY2029, assuming $80-90B annual inflows from MSCI inclusions and bond index upgrades. We’re already fourth globally, behind China ($3.5T+), Japan, and Switzerland, with $702B as of mid-2025.

Pros for hitting it:

- Diversification Play: RBI’s shifting to gold (up 39 tonnes in 2025) and away from US T-bills ($14.5B drop) hedges against dollar woes.

- Growth Engine: 7% GDP trajectory, plus $200B remittances, could add $300B by decade’s end.

- Policy Smarts: RBI’s “adequate reserves” mantra—aiming for 750B-1T per the 2014-15 Economic Survey—keeps interventions lean.

Cons? Global headwinds like US tariffs or Fed hikes could drain $50B overnight. And over-reliance on reserves might inflate the rupee, hurting exporters. As a trader, I’d watch for: If we breach $750B by 2027, bet on INR strength; below $650B, brace for volatility.

Real talk: It’s achievable, but it’ll take disciplined CAPEX and no black swans. Exciting times—could supercharge your EM portfolio.

How India’s Reserves Stack Up Globally: Lessons for Your Trades

India’s not just playing catch-up; we’re lapping the field. Here’s a quick comparison (mid-2025 figures, USD billion):

| Country | Reserves | Rank | Import Cover (Months) |

|---|---|---|---|

| China | 3,571 | 1 | 18+ |

| Japan | 1,300 | 2 | 15 |

| Switzerland | 850 | 3 | 20+ |

| India | 703 | 4 | 11 |

| Russia | 650 | 5 | 12 |

Data: IMF and RBI via Wikipedia.

What can you learn? Unlike China’s export machine, India’s service-led growth (IT, pharma) makes reserves more volatile but resilient. Trade tip: Pair USD/INR with JPY crosses—when yen safe-havens, India’s buffer shines.

For deeper dives, check this IMF report on global reserves or our internal guide on EM currency hedging strategies.

The Pros, Cons, and Real-World Ripple Effects

Pros:

- Rupee Armor: Curbs depreciation; INR’s held steady at 83-88 amid 2025’s tariff storm.

- Investor Magnet: Boosts FII inflows—$20B+ in 2025 so far, per Statista.

- Debt Cushion: Covers 96% of external liabilities, per Forbes.

Cons:

- Opportunity Cost: Hoarding dollars means less domestic investment—could slow that $5T economy dream.

- Valuation Traps: Non-USD assets (euro, yen) swing with forex moves, as seen in the $9B August dip.

- Inflation Risk: Strong reserves might fuel imported inflation if not managed.

A quick anecdote: Back in 2013, reserves plunged to $250B on taper tantrums—I watched clients panic-sell. Today? That buffer would’ve turned losses into gains. Moral: Use reserves data for sentiment trades.

FAQ: Your Burning Questions on India’s Forex Reserves

What is included in India Forex Reserves?

Primarily FCA (87%), gold (13%), SDRs, and IMF position. Mostly US Treasuries for liquidity.

How much are India Forex Reserves in September 2025?

$702.57 billion as of September 19, down slightly from the $703B peak but still robust.

Which country has the highest forex reserves?

China, at over $3.5 trillion—India’s a distant but climbing fourth.

Why did India Forex Reserves increase in 2025?

Remittances, IT exports, and RBI’s gold buys amid lower US yields; $60B YTD surge.

Can India’s reserves hit $1 trillion?

Yes, by 2029 if inflows hold—watch MSCI weights and FDI.

Wrapping Up: Why These Reserves Are Your Trading Edge

Whew—that’s the lay of the land on India Forex Reserves in 2025. From scraping by in the ’90s to eyeing $1 trillion, it’s a testament to smart policy and economic grit. For you, the trading lover scanning charts late into the night, this means confidence: A fortified rupee, juicy carry opportunities, and a market primed for the next leg up.

But markets love surprises—keep an eye on RBI’s weekly drops and Fed moves. Need more? Dive into our full EM reserves toolkit—includes a free downloadable Excel tracker for historical data. Or hit up our Slack community for live chats with fellow traders. What’s your take—bullish on that trillion-dollar milestone? Drop a comment; let’s trade notes.