TradingView Guide for Indian Traders: Free vs Premium Charts

It’s 2 a.m., the Nifty’s futures are twitching like a caffeinated squirrel, and you’re staring at your screen, half-asleep, trying to make sense of that wild candlestick dance. Sound familiar? As an intermediate trader in India’s buzzing markets, you’ve probably been there—chasing setups on NSE stocks or spotting FII flows into Bank Nifty, only to wish your charting tool could read your mind. That’s where TradingView steps in, like that reliable chaiwala who always knows your order. It’s not just a platform; it’s the digital heartbeat for over 100 million traders worldwide, including us desi folks grinding through volatile sessions.

But here’s the thing—TradingView isn’t some magic lamp that grants instant riches (if only!). It’s a powerhouse for analysis, community vibes, and turning market chaos into actionable insights. In this guide, I’ll walk you through what makes TradingView tick, especially for Indian trading lovers like you who juggle everything from Reliance breakouts to USD/INR swings. We’ll dive into its free and premium flavors, chart wizardry, and even peek at alternatives if you’re feeling adventurous. By the end, you’ll have the tools to level up your game without the overwhelm. Ready to chart your path? Let’s roll.

Table of Contents

What Exactly Is TradingView, and Why Should Indian Traders Care?

At its core, TradingView is a cloud-based charting platform that’s part social network, part technical analysis beast. Launched way back in 2011, it lets you visualize stocks, forex, crypto, and commodities with stunning precision—think interactive charts that zoom like Google Earth but for price action. For us in India, where markets run 24/7 across BSE, NSE, and MCX, it’s a lifesaver. No more clunky desktop software that crashes during earnings season.

Why does it matter for intermediate traders like you? Well, you’ve outgrown basic apps that spit out generic signals. TradingView empowers you to build custom strategies, backtest ideas, and chat with global pros about rupee pairs or monsoon-impacted agri futures. According to Statista, India’s stock market participation has exploded to over 100 million accounts by 2025, and tools like this are fueling that fire. It’s not about day-trading every tick; it’s about spotting the big moves, like that post-budget rally in IT stocks last year.

One quick story: A buddy of mine in Mumbai, knee-deep in options on HDFC Bank, switched to TradingView during the 2024 volatility spike. He caught a textbook head-and-shoulders reversal on the 1-hour chart that netted him a tidy 15% swing. Coincidence? Maybe. But tools like this make those “aha” moments less rare.

Read More:

Forex Trading in India: Ultimate Guide for 2025

Colour Trading Explained: Apps, Risks & Tips for Indians

Ek Rupee Coin Ka Manufacturing Cost Kitna Hoga? 2025

Diving Deep: Key Features of TradingView That’ll Supercharge Your Analysis

TradingView’s toolkit is vast, but let’s zero in on what intermediate Indian traders crave—clean visuals, real-time data, and that edge over the herd. Here’s the breakdown:

Advanced Charting: Where the Magic Happens

Forget pixelated scribbles; TradingView’s charts are silky smooth, supporting over 15 types like Renko, Heikin Ashi, and classic candlesticks. For TradingView chart enthusiasts, the real gem is multi-timeframe layouts—plot Nifty daily trends alongside 15-min intraday action without breaking a sweat.

- Drawing Tools Galore: Trendlines, Fibonacci retracements, pitchforks—you name it. I love the auto-Fib tool for quick pullback entries on volatile names like Tata Motors.

- Volume Profile and Heatmaps: See where the big boys (FIIs, anyone?) piled in on Adani stocks. It’s like X-ray vision for liquidity.

- Pine Script Magic: Code your own indicators. Intermediate coders can tweak RSI divergences for INR crosses or build alerts for MCX gold breakouts.

Pro tip: Layer economic calendars right on your chart. With RBI rate decisions looming, you’ll never miss a beat.

Community and Ideas: Learning from the Hive Mind

This is where TradingView feels alive. Over 100,000 scripts and ideas shared daily—filter for “India” and boom, you’re swimming in Nifty forecasts from verified traders. It’s Reddit meets Bloomberg, minus the echo chambers.

As an Indian user, tap into regional chats for rupee-specific takes. Ever wondered why that USD/INR spike coincided with oil surges? Community breakdowns spill the tea.

Alerts and Screeners: Your Personal Market Watchdog

Set custom alerts for price crosses, indicator flips, or even news drops. Screen 1,000+ NSE stocks for RSI oversold setups in seconds. For intermediates, this saves hours—pair it with TradingView’s mobile app for on-the-go checks during Mumbai local commutes.

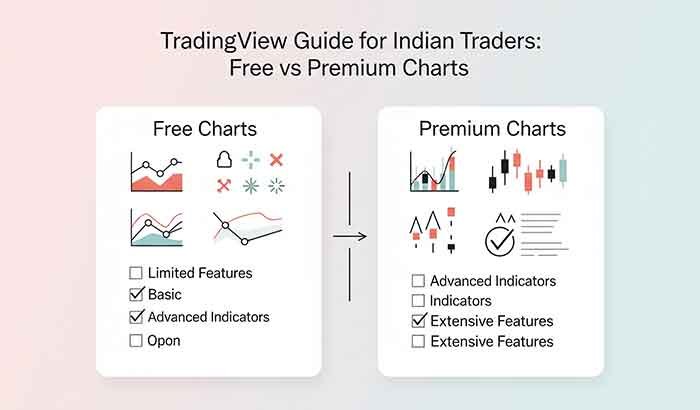

Free vs. Premium: Breaking Down TradingView Free and TradingView Premium

Ah, the eternal debate: Stick with TradingView Free or splurge on TradingView Premium? As an intermediate trader, you’re likely eyeing upgrades for deeper dives. Let’s compare apples-to-apples, based on 2025 pricing tailored for India (billed in INR via local gateways).

| Feature | TradingView Free | TradingView Essential (₹795/mo) | TradingView Plus (₹1,295/mo) | TradingView Premium (₹2,395/mo) |

|---|---|---|---|---|

| Charts per Tab | 1 (basic) | 2 | 4 | 8 (pro-level) |

| Indicators per Chart | Up to 2 | Up to 5 | Up to 10 | Up to 25 |

| Alerts | 1 active | 10 | 200 | 400+ |

| Real-Time Data | Delayed (15-min NSE/BSE) | Real-time for Indian exchanges | Real-time + priority support | Real-time + export tools |

| Ad-Free Experience | No (pop-ups galore) | Yes | Yes | Yes |

| Backtesting | Limited | Basic | Advanced | Unlimited with Pine Script |

| Mobile Optimization | Standard | Enhanced | Enhanced | Full (with custom layouts) |

TradingView Free is a solid starter—perfect for scanning MCX crude or plotting basic EMAs on Sensex. But delays can bite during high-vol sessions, like F&O expiry Fridays. Jump to Essential if you’re serious about real-time NSE feeds; it’s a no-brainer at under ₹800/month.

For full TradingView Premium power, think unlimited watchlists and second-based intervals for scalping Bank Nifty options. Worth it? If you’re trading ₹5-10 lakh positions, absolutely—the ROI from one good setup covers months. External link: Check official pricing updates here for any flash deals.

One caveat: Premium unlocks pro data, but for Indian markets, pair it with brokers like Zerodha or Dhan for seamless execution. Internal link: Dive deeper into broker integrations for Indian traders.

Real-World Use Cases: How Indian Traders Are Crushing It with TradingView

Let’s get practical. You’re not a newbie fumbling with lines; you’re intermediate, so these scenarios hit home.

- Intraday Swings on Nifty 50: Use volume profile to spot support at 24,000. A trader I know nailed a 200-point reversal last Diwali by layering VWAP with MACD crossovers.

- Options Chain Analysis: Premium users get dynamic chains for OI buildup on Reliance calls—crucial for theta plays in choppy markets.

- Crypto-Fiat Pairs: With rupee volatility, chart BTC/INR against global BTC/USD. Spot arbitrage edges before they vanish.

- Backtesting Strategies: Test your EMA crossover on 5 years of HDFC data. Tweak for monsoon dips—pure gold for position sizing.

Data backs it: HubSpot reports that visual tools like TradingView boost decision speed by 30% for active traders. But remember, no tool’s foolproof—always risk 1-2% per trade.

Pros, Cons, and Honest Comparisons: Is TradingView Right for You?

Pros:

- Intuitive UI—feels like sketching on an iPad.

- Massive library: 100k+ indicators, from custom SMC tools to AI-driven sentiment.

- Mobile-first: Trade from your Ola cab without lag.

- Cost-effective for India: Free tier covers 80% of needs.

Cons (and yeah, they’re real):

- Free version’s ads can feel intrusive during focus mode.

- Advanced features locked behind paywalls—frustrating if you’re budget-conscious.

- No native algo trading (yet); you’ll need broker APIs.

Comparisons? Vs. MetaTrader 4/5: TradingView wins on visuals and community, but MT’s better for pure automation. For Indians, ChartIQ (via Groww) is simpler but lacks depth. Alternatives like GoCharting offer offline access at similar prices, per user reviews on forums. If you’re all-in on free, try Investing.com—solid for basics but no Pine Script flair. Internal link: Explore top alternatives roundup.

FAQ: Answering Your Burning TradingView Questions

Is TradingView free for Indian users?

Yes! The basic plan is free forever, with delayed data for NSE/BSE. Upgrade for real-time at ₹795/month. No hidden catches—just ads on free.

How do I get real-time data on TradingView in India?

Subscribe to Essential or higher, then add exchange-specific feeds (₹500-1,000 extra for MCX/NSE). Brokers like Upstox integrate seamlessly.

What’s the difference between TradingView Free and Premium?

Free: Basics + delays. Premium: Unlimited everything, ad-free, priority support. Ideal for intermediates trading options or futures.

Can I use TradingView for paper trading in India?

Absolutely—built-in simulator for NSE stocks. Test strategies risk-free before going live.

Does TradingView support Hindi or regional languages?

English-dominant, but charts are universal. Community ideas often mix Hindi/English for desi vibes.

Wrapping Up: Chart Your Way to Confident Trades

There you have it—TradingView isn’t just software; it’s your trading co-pilot in India’s relentless markets. Whether you’re fine-tuning TradingView charts for that next Adani pump or debating free vs. premium over chai, start small: Sign up free, plot a Nifty setup, and lurk in the India ideas stream. You’ll feel the shift from reactive to proactive trading almost immediately.

Feeling inspired but need more? Grab our free downloadable TradingView Setup Checklist—a quick PDF with 10 intermediate templates for NSE scans. Download here. Or join our vibrant Slack community of Indian traders for live Q&A—drop your biggest pain point, and we’ll brainstorm. What’s one TradingView hack you’re trying this week? Hit the comments; let’s swap stories.