5paisa Review 2025: Login, Share Price & Customer Care

When I first heard about 5paisa back in 2017, I was intrigued by their bold promise: flat ₹20 brokerage per order, regardless of trade size. Fast forward to 2025, and this Mumbai-based discount broker has transformed from an IIFL subsidiary into India’s first listed discount broker, serving millions of retail investors. But is 5paisa the right platform for your trading journey? Let me walk you through everything you need to know.

What is 5paisa? Understanding India’s Discount Brokerage Pioneer

5paisa Capital Limited isn’t just another trading platform—it’s a technology-first financial services company that democratized investing for everyday Indians. Founded in 2007 by Nirmal Jain, the company commenced large-scale operations in 2016 and became publicly listed on BSE and NSE in November 2017.

The company’s name, “5paisa” (literally “5 paise” in Hindi), reflects their original vision of ultra-low-cost trading. While brokerage has since evolved to ₹20 per order, the commitment to affordability remains unchanged.

Quick Snapshot:

- Parent Company: Originally a wholly-owned subsidiary of IIFL Holdings, now independently managed

- Headquarters: Thane, Maharashtra

- Market Cap: Approximately ₹1,000 crores as of October 2025

- Stock Symbol: 5PAISA (NSE/BSE)

- SEBI Registration: Stockbroker, Depository Participant, Research Analyst

- Major Stakeholders: Nirmal Jain (IIFL founder) and Prem Watsa (Fairfax Financial Holdings founder)

Why 5paisa Stands Out in 2025

The Indian broking landscape has become increasingly competitive, with players like Zerodha, Upstox, and Angel One battling for market share. What makes 5paisa different? Three core strengths:

Transparent Flat Pricing: No hidden percentage-based charges that balloon with large trades Technology Integration: Advanced features like AI trading companion (5paisa MCP), TradingView integration, and lightning-fast Scalper Terminal Comprehensive Product Suite: From stocks to mutual funds, IPOs to US equities—all under one roof

5paisa Brokerage Charges: Breaking Down the Cost Structure

One of the most attractive features of 5paisa is its straightforward pricing model. Let me break down exactly what you’ll pay:

Standard Brokerage Plans

Optimum Plan (Default):

- Equity Delivery: ₹20 per order

- Equity Intraday: ₹20 per order

- Futures & Options: ₹20 per order

- Currency & Commodity: ₹20 per order

Platinum Plan:

- All segments: ₹10 per order

- Monthly subscription fee applies

Titanium Plan:

- Equity Delivery: FREE

- Other segments: Competitive rates

- Higher monthly subscription

Account Charges

Account opening is completely free for both trading and demat accounts. Here’s the annual maintenance breakdown:

Demat Account AMC:

- Holdings below ₹50,000: ₹0 per month

- Holdings ₹50,000 – ₹2,00,000: ₹5 per month

- Holdings above ₹2,00,000: ₹25 per month

- Multiple demat accounts: ₹25 per month

Real-World Example:

Imagine you’re an intermediate trader executing 100 trades monthly across equity and F&O. With 5paisa’s ₹20 flat rate, your total brokerage is ₹2,000. A traditional broker charging 0.03% would cost you significantly more on a ₹10 lakh trade (₹300 per trade × 100 trades = ₹30,000).

Other Charges to Know

Beyond brokerage, every trade incurs statutory charges:

- STT (Securities Transaction Tax): Government-mandated

- Exchange Transaction Charges: NSE/BSE fees

- GST: 18% on brokerage

- SEBI Turnover Fees: 0.0001% of turnover

- Stamp Duty: As per state regulations

💡 Pro Tip: Always use the 5paisa brokerage calculator before placing large orders to understand your total cost, including all statutory charges.

5paisa Login Process: Accessing Your Trading Account

Getting into your 5paisa account is straightforward, but security is paramount. Here’s how it works across different platforms:

Step-by-Step Login Guide

For Web Platform:

- Visit login.5paisa.com

- Enter your User ID (Client Code, email, or mobile number)

- Input your password

- Verify with Date of Birth (DOB)

- Enter MPIN for additional security

For Mobile App:

- Download 5paisa app from Google Play Store or Apple App Store

- Tap “Login” on the home screen

- Enter registered email/client code/mobile number

- Add your password and DOB

- Set up biometric authentication (fingerprint/Face ID) for faster future logins

For Desktop Trading Terminal (Trade Station):

5paisa offers Trade Station, a desktop application with advanced features for serious traders. Login process mirrors the web platform but provides enhanced charting and execution capabilities.

Forgot Password? Here’s the Reset Process

If you need to change your login password, visit the 5paisa login page, click “Forgot Password,” enter your email ID or client code, verify via OTP, and create a new strong password combining special characters, numbers, and alphabets.

Common Login Issues & Solutions

Issue 1: “Invalid Credentials” Error

- Solution: Double-check your User ID format. Remember, you can login with client code, email, or mobile number.

Issue 2: OTP Not Received

- Solution: Check spam folder. Ensure your registered mobile number is active. Wait 30 seconds before requesting resend.

Issue 3: Account Locked After Multiple Attempts

- Solution: Contact 5paisa customer care at +91 89766 89766 for immediate account unlock assistance.

Security Best Practices

Based on my years covering fintech security, here are essential tips:

- Never share your password or MPIN with anyone, including 5paisa employees

- Enable Two-Factor Authentication (2FA) for all login attempts

- Change passwords regularly, ideally every 90 days

- Use strong passwords with minimum 12 characters mixing uppercase, lowercase, numbers, and symbols

- Logout after sessions, especially on shared devices

- Monitor account activity regularly through transaction statements

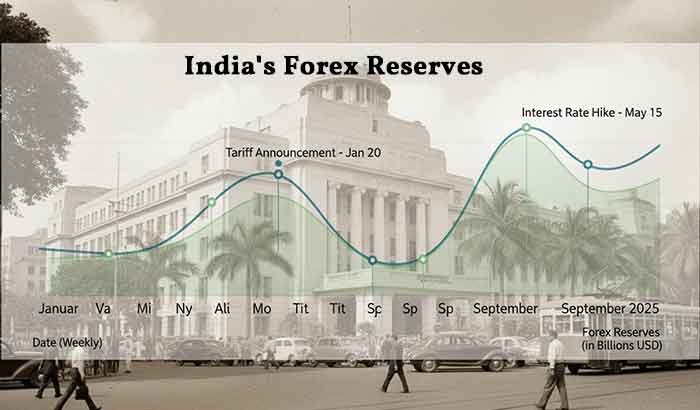

5paisa Share Price Analysis: Understanding Stock Performance

For investors considering 5paisa not just as a platform but as an investment opportunity, let’s examine the company’s stock performance.

Current Market Performance (October 2025)

As of October 14, 2025, 5paisa Capital trades at ₹313.65 per share with a market capitalization of approximately ₹999.82 crores. The stock has experienced considerable volatility over the past year.

52-Week Performance:

- 52-Week High: ₹607.05

- 52-Week Low: ₹311.65

- Year-over-year return: Approximately -36% (as of September 2025)

Key Valuation Metrics:

- P/E Ratio: 14.65

- P/B Ratio: 1.66

- Sector: Financials – Diversified Financial Services

What’s Driving Stock Performance?

Several factors influence 5paisa’s stock trajectory:

Positive Catalysts:

- Growing user base in discount broking segment

- Successful events like the 5paisa Algo Convention 2025 at BSE, which attracted 700+ traders and showcased algorithmic trading capabilities

- AI integration through Model Context Protocol (MCP), allowing users to interact with Claude AI for trading tasks using natural language

- Expansion into robo-advisory and wealth management

Challenges:

- Net profit declined 42.51% to ₹11.55 crore in Q1 FY2025-26 compared to ₹20.09 crore in the previous year’s quarter

- Intense competition from larger players like Zerodha and Groww

- Low promoter holding at 32.8%

- Market volatility affecting trading volumes

Recent Corporate Developments

Leadership Changes: In January 2025, 5paisa Capital appointed Gaurav Seth as Chief Executive Officer, signaling strategic repositioning.

Technology Enhancements: The company continues investing heavily in tech infrastructure, with new features like Scalper Terminal for lightning-fast execution, Pay Later MTF for margin trading, and direct TradingView chart integration.

Should You Invest in 5paisa Stock?

Disclaimer: I’m not a financial advisor, and this isn’t investment advice. Always conduct your own research or consult a certified financial planner.

That said, here’s my analytical perspective:

For Long-Term Investors: 5paisa operates in a high-growth sector. India’s retail participation in equity markets continues expanding, benefiting discount brokers. However, profitability concerns and promoter holding percentages warrant caution.

For Traders: The stock shows high beta, meaning significant price swings. Options traders might find opportunities in volatility, but risk management is crucial.

Analyst Consensus: According to analyst recommendations, 5paisa Capital has a “Buy” rating for the long term, though individual circumstances vary.

5paisa Trading Platforms: Tools for Every Trader

Technology defines modern trading, and 5paisa has invested substantially in building robust platforms. Let me walk you through each option:

1. 5paisa Mobile Trading App

Available on: Android and iOS

The 5paisa mobile app was awarded Best Mobile Trading App in 2018 and remains the primary trading interface for most users.

Standout Features:

- All-in-One Platform: Trade stocks, F&O, commodities, currencies, plus invest in mutual funds and IPOs—all from one app

- Advanced Charting: Powered by TradingView and ChartIQ for real-time technical analysis

- Stock SIP: Automated systematic investment plans in individual stocks

- Portfolio Dashboard: Combined view of equity and mutual fund holdings

- FnO 360: Real-time Options Chain with 16+ Greeks, Straddle Chain, Open Interest graphs, and F&O momentum indicators

- Smart Strategies: Pre-defined options strategies with bulk order placement

- Biometric Login: Fingerprint and Face ID authentication for instant access

User Experience: The interface is clean and intuitive. Even intermediate traders who aren’t tech-savvy find navigation straightforward. Market depth, order book, and positions appear in a single view, reducing screen-switching.

Security Features: The app implements two-factor authentication (2FA), UPI-based payments, robust encryption, and instant login with biometrics, ensuring your funds and data remain protected.

2. Trade Station Web

Access: Via 5paisa website

Perfect for traders who prefer larger screens. The web platform offers:

- Comprehensive Dashboard: Portfolio tracking, fund management, and order placement

- 20 Years Historical Data: Essential for fundamental analysis and backtesting strategies

- Bracket & Cover Orders: Advanced order types for risk management

- After-Market Orders: Place orders when markets are closed

- Market Watch with Sparklines: Instant overview of offer rate, bid quantity, and stock trends

3. Trade Station 2.0 (Desktop Application)

For: Professional traders requiring advanced tools

Trade Station is a desktop application with several advanced features, though traders need to familiarize themselves with its extensive functionality.

Key Capabilities:

- Lightning-fast execution speeds

- Advanced technical indicators

- Multi-monitor support

- Customizable layouts

- Real-time streaming data

4. FnO 360 Web Terminal

FnO 360 is a dedicated web-based terminal exclusively for derivatives traders, offering:

Pre-Defined Strategies:

- Straddle/Strangle setups

- Bull Call/Put Spreads

- Breakout strategies

- Momentum strategies

Open Interest Analysis: Monitor OI changes across strike prices and expiries to gauge market sentiment.

India VIX Integration: India VIX, the most reliable market volatility indicator, helps traders assess risk and adjust strategies accordingly.

5. Algo Trading Platform

For quantitative traders, 5paisa offers algorithmic trading capabilities:

Features include preloaded algos like Amibroker, Jobbing, Pivot strategies, Buy/Sell call execution, Bulk buy/sell, and Paired spread trading.

Integration Options: Compatible with popular platforms like Amibroker, MetaTrader, TradingView, Excel, and Python for custom strategy implementation.

6. Robo Advisory

5paisa’s robo advisory is a fully automated tool that suggests mutual funds based on your financial goals, time frame, and income profile.

Perfect for:

- First-time mutual fund investors

- Busy professionals seeking automated portfolio management

- Long-term wealth creation without active management

5paisa Customer Care: Getting Help When You Need It

Quality customer support can make or break your trading experience. Here’s how to reach 5paisa when issues arise:

Primary Contact Channels

Customer Care Hotline: +91 89766 89766 (Monday-Friday, 8:30 AM – 6:00 PM)

Email Support: support@5paisa.com for general trading queries dp.grievance@5paisa.com for Depository Participant and broking-related grievances

Cyber Security Incidents: For specific cyber security matters like suspected account hacking or unauthorized profile modifications, contact CISO@5paisa.com or call 08035435711. These issues are addressed within 3 business days.

Corporate Office Address

5paisa Capital Limited IIFL House, Sun Infotech Park Road No. 16V, Plot No. B-23, MIDC Thane Industrial Area, Wagle Estate Thane, Maharashtra – 400604

My Experience with 5paisa Support

Full transparency: 5paisa’s customer service is functional but not exceptional. Being a discount broker, they prioritize cost efficiency over premium support. Here’s what to expect:

Response Times:

- Phone support: Typically 5-15 minutes wait during market hours

- Email queries: 24-48 hours for resolution

- Cyber security issues: Within 3 business days

Support Quality: Representatives can handle standard queries—account opening, password resets, brokerage clarifications. Complex technical issues might require escalation and longer resolution times.

When to Escalate

If your issue isn’t resolved through standard channels:

- Grievance Officer: Contact Mr. Ravindra Kalvankar, Chief Compliance Officer, at csteam@5paisa.com

- Investor Relations: For financial statement queries, reach out to ir@5paisa.com

- SEBI SCORES Portal: Lodge complaints through the official SEBI complaint platform if internal escalation fails

Self-Help Resources

Before calling customer care, check these:

- Knowledge Base: 5paisa forum at forum.5paisa.com

- Video Tutorials: YouTube channel with platform walkthroughs

- FAQ Section: Comprehensive answers to common questions on the website

Opening a 5paisa Demat Account: Complete Walkthrough

Ready to start trading with 5paisa? The account opening process is refreshingly simple. Let me guide you through it:

Prerequisites

Required Documents:

- PAN Card (mandatory)

- Aadhaar Card (for e-KYC)

- Bank Account Proof (cancelled cheque or bank statement)

- Live Selfie (taken during application)

- Digital Signature (captured via e-sign)

Step-by-Step Online Process

With 5paisa, you can open a demat account within 5 minutes through a fully online process. Here’s how:

Step 1: Registration Visit 5paisa website or download the app. Enter your mobile number and email ID for OTP verification.

Step 2: Basic Details Provide your PAN number and date of birth. The system auto-fetches details from KYC databases.

Step 3: KYC Verification Complete Aadhaar-based e-KYC using OTP sent to your registered mobile number.

Step 4: Bank Details Enter your bank account information. Upload a cancelled cheque or recent bank statement.

Step 5: Personal Information Fill in address, occupation, income details, and trading experience.

Step 6: In-Person Verification (IPV) Record a short video of yourself with your face clearly visible as mandated by SEBI for authenticity verification.

Step 7: Segment Selection Choose trading segments you want access to: Equity, F&O, Currency, Commodity.

Step 8: E-Sign Digitally sign your account opening form using Aadhaar-based e-sign. An OTP will be sent to your Aadhaar-linked mobile number.

Step 9: Review & Submit Double-check all details before final submission.

Read More: Ek Rupee Coin Ka Manufacturing Cost Kitna Hoga? 2025

After Submission: What Happens Next?

The verification process typically takes up to 48 hours. Once approved, you’ll receive login credentials via email and SMS.

Your Unique Client ID: You’ll receive a 16-digit client ID—the last 8 digits uniquely identify you, while the first 8 identify the depository participant (5paisa).

Offline Account Opening Option

For those uncomfortable with online processes, 5paisa offers offline account opening where you visit their branch, submit physical documents, and complete the process in person.

Steps:

- Download account opening form from 5paisa website

- Fill it completely with accurate information

- Attach self-attested copies of required documents

- Visit nearest 5paisa branch or partner location

- Complete in-person verification

- Submit the form and documents

- Await account activation (typically 3-5 business days)

BSDA Account Option

If your holdings are below ₹2 lakhs, consider opening a Basic Services Demat Account (BSDA):

- Zero annual maintenance charges

- Lower transaction fees

- Ideal for small investors

Simply tick the BSDA option during account opening.

5paisa Product Portfolio: Beyond Just Trading

One significant advantage of 5paisa is their comprehensive product suite. You’re not limited to stock trading—here’s everything you can access:

1. Equity & Derivatives

Cash Segment: Trade stocks on NSE and BSE with flat ₹20 brokerage. No separate charges for delivery trades.

Futures & Options: Access sophisticated F&O tools including FnO 360 with live Options Chain data, 16+ Greeks calculation in real-time, and pre-defined strategy builders.

Margin Trading Facility (MTF): 5paisa’s “Pay Later MTF” allows you to seize market opportunities instantly and settle payments later, providing leveraged trading capability.

2. Mutual Funds

Zero Commission: Invest in 9,000+ mutual fund schemes with absolutely no brokerage or commission charges. This is huge—traditional advisors charge 0.5-1% annually.

Robo Advisory: Algorithm-driven fund recommendations based on your risk profile, investment horizon, and financial goals.

SIP Automation: Set up monthly systematic investment plans starting from as low as ₹500.

3. IPO Applications

Apply for Initial Public Offerings directly through the 5paisa platform:

- No application charges

- Instant UPI-based payment

- Allotment status updates via SMS and email

- Automatic credit to demat account upon allotment

4. Commodities & Currency

Commodity Trading: Access MCX for gold, silver, crude oil, natural gas, and agricultural commodities.

Currency Trading: Trade major currency pairs on NSE Currency Derivatives with same flat ₹20 brokerage.

5. US Stocks

Invest in American markets directly from your 5paisa account. Trade Apple, Tesla, Amazon, and other US equities with transparent pricing.

6. Bonds & Fixed Income

Purchase government securities, corporate bonds, and debentures for stable returns.

7. Insurance Products

Access term insurance, health insurance, and investment-linked insurance plans through 5paisa’s partnership network.

8. Personal Loans

Quick personal loans with competitive interest rates, processed entirely online.

Advanced Features: What Sets 5paisa Apart in 2025

Beyond basic trading, 5paisa has rolled out cutting-edge features that intermediate traders will appreciate:

1. AI Trading Companion (5paisa MCP)

The Model Context Protocol integration allows users to interact with AI through natural conversations for trading tasks. Imagine asking, “Show me top-performing mid-cap stocks with RSI below 30” and getting instant, actionable results.

2. Scalper Terminal

This lightning-fast interface enables instant keyboard execution, perfect for scalpers who need millisecond advantages. Pre-defined hotkeys for buy/sell actions eliminate mouse delays.

3. Trade on TradingView Charts

Through Tv.5paisa integration, execute trades directly from TradingView charts without switching platforms. This seamless workflow is a game-changer for technical traders who rely on TradingView’s superior charting tools.

4. Voice-Based Trading

While still evolving, 5paisa is exploring voice command trading for hands-free order placement—particularly useful during high-volatility periods.

5. Smart Screeners

Filter stocks using 300+ parameters including:

- Fundamental metrics (P/E, P/B, ROE, Debt-Equity)

- Technical indicators (RSI, MACD, Bollinger Bands)

- Price action patterns (Breakouts, Support/Resistance)

- Volume analysis (Unusual activity, Accumulation/Distribution)

6. Portfolio Analytics

Deep-dive into your portfolio performance:

- Sector allocation analysis

- Risk assessment scores

- Tax harvesting recommendations

- Dividend tracking

- Capital gains/loss statements

Key Takeaways: Is 5paisa Right for You?

After this comprehensive exploration, let’s crystallize the insights:

✅ 5paisa is Excellent For:

Cost-Conscious Traders: Flat ₹20 brokerage saves significantly on frequent trading compared to percentage-based models.

Tech-Savvy Investors: Advanced platforms, AI integration, and algo trading appeal to modern traders comfortable with technology.

Diversified Investors: All-in-one access to stocks, mutual funds, IPOs, bonds, and more eliminates the need for multiple broker accounts.

Options Traders: FnO 360’s comprehensive Greeks analysis and strategy builders provide professional-grade tools.

SIP Enthusiasts: Zero-commission mutual fund investing makes systematic wealth building affordable.

⚠️ Areas Where 5paisa Could Improve:

Customer Support: Being a discount broker, support quality is average. Complex issues may take longer to resolve.

Research Quality: While basic research is provided, it doesn’t match full-service brokers’ institutional-grade analysis.

Branch Network: Limited physical presence compared to traditional brokers. Some investors prefer face-to-face interactions.

Platform Stability: During extreme market volatility, some users report occasional lag or connectivity issues.

The Bottom Line

5paisa represents the modern evolution of Indian broking—technology-driven, affordable, and comprehensive. For intermediate traders who understand market mechanics and don’t require hand-holding, it’s an excellent choice.

However, if you’re looking for dedicated relationship managers, extensive research support, or prefer traditional broker interactions, full-service brokers might suit you better despite higher costs.

Frequently Asked Questions (FAQs)

Is 5paisa safe and regulated?

Yes, absolutely. 5paisa Capital is registered with SEBI as a stockbroker, depository participant, and research analyst, and with AMFI as a mutual fund distributor. As a publicly-traded company listed on NSE and BSE, they adhere to strict regulatory compliance.

Can beginners use 5paisa effectively?

5paisa is considered suitable for beginners, operating as a discount broker with a user-friendly platform, low brokerage fees, educational resources, research tools, and a simple interface. The learning curve is manageable with available tutorials and support.

What happens if I forget my 5paisa login credentials?

Use the “Forgot Password” feature on the login page. You’ll receive OTP verification on your registered mobile and email to reset your password securely. For MPIN issues, contact customer care.

Are there any hidden charges beyond the ₹20 brokerage?

The ₹20 brokerage is transparent, but statutory charges apply to all trades: STT, exchange transaction fees, GST (18% on brokerage), SEBI fees, and stamp duty. These are government-mandated and applicable across all brokers.

Can I trade IPOs through 5paisa?

Yes, 5paisa offers zero-charge IPO application services. You can apply for both mainboard and SME IPOs directly through the app with UPI-based payment.

How do I transfer shares from another broker to 5paisa?

Initiate a Delivery Instruction Slip (DIS) transfer through your existing demat account. Contact 5paisa support for detailed guidance on the inter-depository transfer process.

Does 5paisa offer margin against shares?

Yes, 5paisa provides margin against shares through pledging. They maintain a list of approved securities eligible for collateral.

Can NRIs open accounts with 5paisa?

Yes, NRIs can open demat accounts with 5paisa, choosing between repatriable and non-repatriable accounts depending on whether funds will be transferred abroad or kept in India.

Conclusion: Making Your Decision

Choosing a broker is deeply personal—it depends on your trading style, technical comfort, budget, and support expectations. 5paisa excels in affordability, technology, and product diversity. Their flat brokerage model alone can save intermediate traders thousands annually.

However, remember that the cheapest option isn’t always the best fit. Evaluate your priorities: Do you need extensive research? Regular educational webinars? Dedicated relationship management? Or are you self-sufficient, seeking primarily low costs and robust technology?

From my perspective covering fintech and trading platforms since 2018, 5paisa has matured significantly. Their AI integration, algo trading capabilities, and comprehensive mobile app demonstrate genuine innovation. The company’s public listing also adds accountability and transparency.

If you’re an intermediate trader comfortable with technology, have basic market knowledge, and want to keep costs low while accessing diverse investment products, 5paisa deserves serious consideration. Start small, test their platforms, evaluate customer support responsiveness with a few queries, and then scale up your trading activity once comfortable.

Next Steps:

Ready to explore 5paisa? Visit their website, complete the quick 5-minute account opening, and experience the platform firsthand. Most importantly, never invest money you can’t afford to lose, maintain disciplined risk management, and continue learning—that’s the real key to trading success.

Author Bio

Financial Technology Analyst & Trading Platform Expert

With over 6 years covering India’s evolving fintech landscape, I’ve analyzed dozens of broking platforms, interviewed industry leaders, and maintained personal trading accounts across multiple brokers to provide authentic, experience-based insights. My goal is simple: help Indian investors make informed decisions in an increasingly complex financial world.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial advice, investment recommendations, or solicitation to open accounts with any particular broker. Trading and investing involve substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and consult certified financial advisors before making investment decisions. The author may or may not hold positions in securities mentioned.